you’re using what, 4 480’s? not sure what kind of cut nicehash takes.

I pay $0.08125 per KwH. 1.2*24*0.08125*31 = $70. I actually pay $100-$130 so I know my GPUs aren’t the most efficient Hash:Watt ratio.

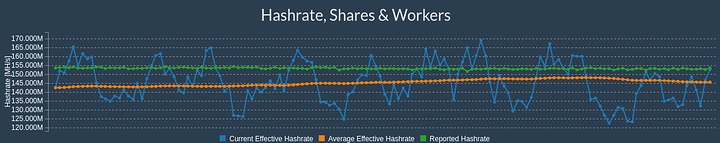

Not sure what you mean by “1.3”, but it is about 140 MH/s.

Related:

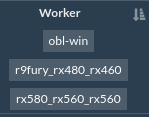

Actual hardware I use:

Obl-Win is a Radeon Pro Duo (two Fury Nanos) - 250-300w and about 50-60 MH/s

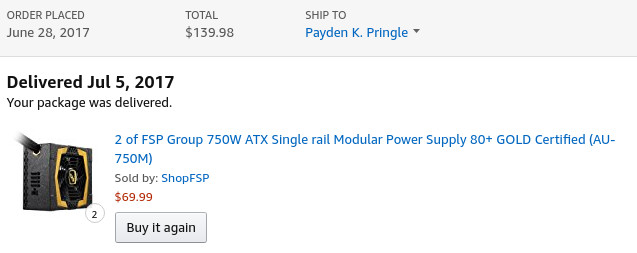

I didn’t buy a single PSU because I realized it wasn’t necessary. Went for best Price:Wattage Ratio and found these to be that using PCPartPicker:

That’s accurate. I spent about $2,000 or so. Not sure on the cheaping out bit. Everything I have has worked almost flawlessly beyond typical miner problems (Windows 10 auto installing drivers is a blessing and a curse).

Again, there are too many variables with equipment overhead to reliably consider if you are profitable or not.

If I resold all my hardware right now, I don’t know what I’d get for it. Even if I did know, for a fact, I’d get over $1500 for it, then I’m profitable because $640+$1500 = $2,140 and I spent about $2,000 so I made $140. Which is profit.

That’s why I don’t consider it. It’s retarded to only consider the negative side of equipment overhead and not the positive if you know you intend to sell it later. It is too much work and probably impossible to try and estimate what you’d make on selling the hardware later anyway to see if you’re profitable.

So the only real, reliable, way to discern whether you will make money in the end, or not, is to ignore equipment overhead altogether and focus on making money through resource trading, electricity to coins.

On an infinite time frame, or even a 2 year time frame, that will likely lead to certain profitability even when ignoring equipment overhead, assuming you don’t mine the same thing the entire time.

crypto was measured against raw investment

How does that mean that one thing is not profitable if another thing is more profitable? Because that’s the definition you keep using. As a hypothetical, if I can make $1,000 mining, or I can make $2,000 renting compute power, you are saying mining is not profitable, even though you can make $1,000 with it, because you can make $1,000 more with renting.

How does this statement equate to that definition? If it doesn’t, then why are you using that definition? If you’re not, then why make statements that say that?

No. It is logical that if you use a definition as I stated above that people will have more F.U.D. towards mining when their numbers don’t match what you are saying. If you’re saying mining is not profitable, the “industry standard” way, when it is in fact profitable, the “general standard definition” way, it creates confusion, and thereby, F.U.D.

It’s not about what I disagree with. I don’t have to disagree with what you’re saying to understand what you’re saying likely has that effect.

Yeah, I did the most efficient case at a reasonable power cost average, because I’m trying to honestly represent the situation as much as possible.

No, they’re known constants. Initial capital investment = one-time overhead

yeah, sorry I wasn’t clear, I meant 1.3 eth/mo

What? This is the primary concern in starting literally any venture. It’s initial investment. You paid for the HW, meaning it gets taken out of the revenue as a one time cost. You can’t say “If I sold my durable production capital I’d be slightly profitable.” That’s literally saying “I’ll be profitable as soon as I get out of the mining business.”

Your equipment is not liquid, and it is an expense until you pay for it with production. This shit is business and econ 101

I’ve said like 5 times it’s the industry definition. The incentive models involved in non-asic mining necessitate factoring in a different risk profile than other kinds of “manufacturing.” not gonna go into every detail of why because there’s a ton of them. I even showed pretty definitively that it isn’t profitable under the wider, more general definition, either.

I’m not misleading people or spreading misinformation. It isn’t profitable since the craze, even under a more basic, general model. If I took into account difficulty and volatility projections it’d look even worse. If I took into account other parts of the risk profile, it’d look yet worse still.

Not if you’re reselling them and don’t know what they’ll sell for later.

It’s dumb to say “you aren’t profitable until you make back all the money you spent on hardware” when you’re going to sell the hardware later. That money you sold the hardware back for is part of ultimate profitability, so either do one with the other or don’t do either. I guess viewing the negative and not the positive transaction is a more conservative method to ensure profits, but I’m not going to do that for varying reasons I’ve already listed.

Ah, right. I had guessed you meant a version number or some DAG major version number, but glad you clarified.

It is, because that’s what it is. Overall, if I’m asking myself “is mining worth it for me?” or “Will I make money overall, when mining?” The final sale of hardware factors into that. And it should because it’s money gained from the venture one way or another. If you know for a fact you’ll regain a notable portion of initial investment once the investment period is over (when you exit mining), imo it doesn’t make sense to not consider that in final profitability.

But I’m a small miner and not a business. My equipment is effectively liquid as long as mining has a clamp on the GPU market’s supply.

Situational context is important. This might not be true when I actually decide to sell my hardware. But right now it is true.

Doesn’t matter if the industry definition is illogical relative to the general definition and the thing normal people care about is the general definition. It makes 100% sense to use the industry standard definition when talking to major mining companies, but we aren’t that. We care about getting more than we put in, in the end, and that’s all that matters.

Again, what you’re saying makes plenty of sense when it comes to operating like a company, but isn’t that what this whole thread is? Trying to show it isn’t worth mining for hobbyists?

I’m a hobbyist. By my definition, which is the accurate one for most investments, I’m making money, not losing it.

I don’t see how you showed that with what you’ve said. If I sold all my hardware and coins right now, I’d be in the positive overall, and again, for a small miner, that’s all that matters. If I must consider initial investment, I must consider what I recoup from selling that hardware. Both are one time costs that are very deeply related, so it’s logical to do that.

I disagree with you there for varying reasons. Mainly that saying “It’s not profitable” when you make more money than you spend doing it. That confuses more people than it will inform.

You didn’t answer this question:

Regarding this statement:

It probably sounds as wrong to me to say one thing is not profitable because another thing is more profitable as it is to you to count both equipment overhead and its resale value when considering profitability.

If I’m making money, that’s all that matters. Anyone would want to make more, but “not making more money” isn’t the same as “not making money.”

I’ll come back in 4 months and we’ll see I guess.

Oh, I forgot to mention, I’ve been dual mining as well with those hash rates on Ethereum. Add like $30-$50 per month would put my total revenue at like $300-$350 at current prices.

Are you mining to make money? Then it’s a side business. Doesn’t matter how big or small you are, or if you consider it a hobby.

No, it isn’t. You can’t incorporate resale into your profit model unless you continually resell as a supplement to your main revenue stream, in which case you’re still in business while selling, and even then, you’re making tiny margins assuming you want to maintain hashpower.

again, what? Standard metrics don’t suddenly become invalid if you don’t like them, and neither does basic economics.

dude, you gave me 260, I went with 260. But if you want to move goal posts, at the current difficulty increase of ~30% (400ish T) month over month, you’re looking at 260 again next month.

Literally the best thing that can happen for eth miners long term is a crash. difficulty tanks temporarily. If this crash pans out in full, then mining will be profitable again for eth long miners.

But if it crashes, that’s the craze ended, so mining will be profitable because the craze ended.

Relevant economic principles are decided by scale. Just as some things only make sense at a huge scale, some things only make sense at a small scale.

And yet I’m going to, and I’m going to make profits once all is said and done.

Again, it doesn’t matter what an industry does. For an individual (which this thread is about, not companies) who is doing this out of their home on a small single-system scale (like a hobbyist would), what I say makes sense and what you say doesn’t imo.

The part of that post you replied to is talking about the definition you keep using. It’s not basic economics to say “not making the most money is not profitable”.

You keep saying “industry standard”. Can you show me how it is an industry standard? Perhaps in articles talking about the industry which show that is the standard form used for profitability?

That was meant purely for informational purposes and not meant as a jab in saying “you’re wrong about that too.”

Odd thing. My Ethereum per month went up last DAG. AFAIK for Ethereum, DAGs are the adjustments for difficulty.

Not sure why my ETH output went up by 5.38% (1.30 to 1.37). Only logical reasons I can come up with is that the difficulty went down, or luck improved temporarily.

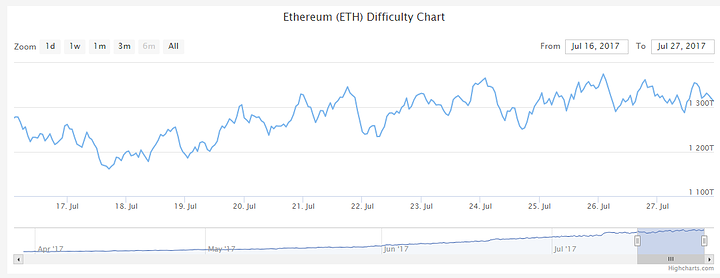

Chart here shows difficulty is normal:

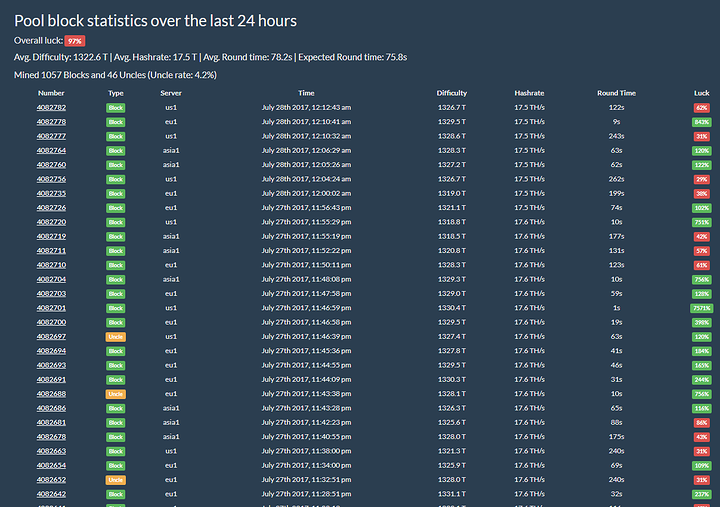

Luck estimate here shows Luck is down for this pool overall:

¯\_(ツ)_/¯

Between that anomaly and Ethereum’s SEC investigation, I’m not worried about Variable Difficulty.

Chart shows a ~30+% increase month to month. 950ish T to 1320 T. That means mining is getting harder at a constant hshrate.

Bruh:

A DAG is the dataset portion of the Eth hashing algo. The algo adjusts difficulty, but they’re two separate things. Higher difficulty == less likelihood of a payout at a constant hash rate.

Your pool got more payout in the difficulty valleys than on the crests. You beat the spread for one month. That doesn’t mean difficulty isn’t a real concern for mining.

Initial investment is always a relevant factor, unless you’re in the business of getting hit with meteors made of cash.

Simplest way I can explain it is this:

You make 1040 mining, you sell your means to mining for 1500. You made more money getting out of mining than you did mining. Your mining net profits, assuming 2k startup investment plus 400 in power, is -1360. You broke even/profited by getting out of business, not by mining. The opportunity cost is mining for the sell-off. If mining were profitable, then you would have stayed in business. You made 150 bucks, but your mining venture lost you money. You hedged against your mining business buy liquidating and closing up shop.

Think of it this way: you start a tech startup. You then sell off that startup to someone else. your company hadn’t made up your initial investment, so it wasn’t profitable. You made money off the deal, more than enough to cover your initial investment, but the business still isn’t profitable, and is less so for the buyer because they paid more for it than you did.

Profit is Revenue minus expenditures. Going out of business isn’t revenue, it’s a hedge against loss. It’s a non-factor in the initial venture’s profit.

It is a Ponzi in the sense that those who got in early on will reap the most rewards. It’s no different than how the gold rush worked. The miners that mined the early claims hit paydirt, while the people that came later on found the mines to have been depleted. Again, the real winners were the businesses that followed the miners and offered goods and services they needed and wanted.

If we’re talking bitcoin that isn’t true. There isn’t a single (legitimate) business attached to bitcoin that wouldn’t have made more money just buying or mining the stuff. Few if any are reporting profits, and the ones that are are treading water, as in completely borderline. (exchanges don’t count, they’re hedged against bitcoin, and they’re making money on arbitrage, not a direct service.)

also, it’s a bubble, not a ponzi. Mining eth is legitimate business people mining for a ponzi (or unregulated security depending on who you ask), but the mining itself isn’t a ponzi

so long as your under i believe 500 a year then you dont have to report it as a taxable income

I just want to get the numbers straight here.

- You bought your rig for $2000.

- You spend $130/month on electricity.

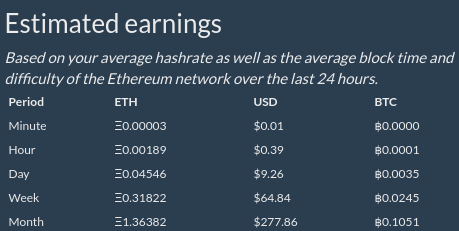

- This month you earned $260 worth of eth.

- You expect you could resell your miner for $1500 right now.

Three questions:

- Difficulty of mining eth is going up. You said you earned $260 this month, how much do you expect to earn next month as a percentage of that?

- How fast do you expect the resell value of your miner to degrade? Give me an estimated loss in value per month.

- What’s your methodology for spending your eth?

Yes. Until such time as you actually do sell them. Up till then, they’re either expenses that you account for in your finances, or they’re just gambling.

Yes. Note I earned between $30 and $50 of other currencies in tandem. It was split between Decred and SiaCoin.

$230-$240 for Eth alone, with $30-$40 on alternate currencies (Decred for now). So totaling $260-$280 instead of $290-$310.

It’s not a flat scale so saying “$X per month” isn’t logical. On average between now and 1 year from now, I’d estimate the average $ lost would be $50 assuming 12 months from now it is then worth $900 instead of $1500. The dollar amount the equipment depreciates at is related to what goes on in the mining world. If GPU mining dies again, I lose more than expected, and if it doesn’t, I don’t.

I feel that estimate is liberal. Meaning I think it won’t be $900 but higher than that (less than $1500 though) in 12 months.

- use local wallet for mining

- transfer to Poloniex

- trade for BTC

- hold until BTC starts to drop and trade for USD at that point

I understand that thought process for a business, but I’m 100% certain I will sell them in the future and I’m 100% certain someone will buy them in the future. The amount is the questionable bit.

So not accounting for it is not something that makes sense for an individual mining when those things are true.

how much do you expect to get in USD per eth?

he’s holding, so it’s be whatever the market price is.

use coinmarketcap.com if you want to be lazy and not have to manually average exchanges.

You’re right, let me just go set all my laptops to mine Morano real quick

The USD when I mine it has been about $260 ($200*1.3), but like tkoham mentioned, I’m holding for now.

None of my profits are profits until I withdraw them from Poloniex. I’m going to basically keep all my profits there as coins until I find an ideal exit from BTC (I trade all ETH to BTC as soon as I get it).

So, I mean, I’m not exactly “just holding”, but I’m not taking the profits out to spend them on stuff either. They’re still invested.

If I mine 1 Ethereum now and it is worth $200, but I don’t sell it until it is somehow worth $400, my actual revenue from my time mining that 1 coin is $400 and not $200. So it just makes sense to me to hold as long as I don’t need the profits right now. That has the potential to maximize (or cripple) my profits.

it’s not business vs. individual. it’s having a realistic view of finances vs. not (which businesses can do a bad job of also, btw).

You’re right that they can, but I think it’s just as realistic that I will sell my hardware at some point in the future for a notable amount of money.

Ignoring that to decide if I’m profitable or not doesn’t make sense to me.