Ethereum*

Define profitable.

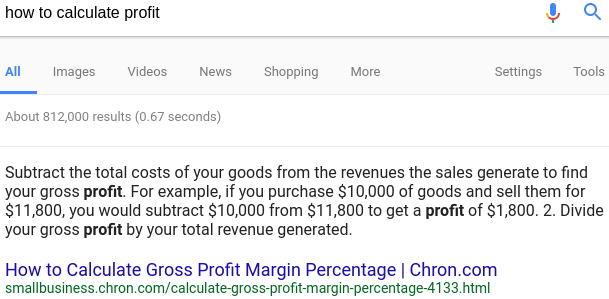

I’m making approximately 1.3 Eth per month which at current prices is about $260. I spend $100 per month on electricity.

This won’t last for a lot of reasons, but I think you are factually wrong with that statement.

Every model I’ve seen under a certain scale using non-commercial electricity rates relies on a price rise over the next months to be profitable. Relying on market volatility == non profitable because the benchmark isn’t whether you’re making more than you’re spending on electricity, it’s whether or not you’re outperforming simply buying and holding the crypto over the same ROI period.

When the craze started there was around a 2x pump frome baseline, and peak avg. ROI was just before the massive correction. had you bought rig + electricity value in eth and dumped, you’d have made much, much more, and not had to try and sell off all that pesky mining junk.

What are you on about? it’s trading at ~$202 trending down.

There is another problem, when the SEC decides all cryptocurrency mining are securities miners will have to get a security trading license just to be able to exchange their coins.

all cryptocurrency mining are securities

Not all. Just ERC20 tokens and anything with a crowdsale (ethereum, zcash, possibly dash, dozens of smaller shitcoins)

BTC, Monero, LTC are strictly exempt and pass the howie test.

it’s whether or not you’re outperforming simply buying and holding the crypto over the same ROI period.

Well considering you have said it is trending downward, the obvious answer is “yes mining is more profitable than buying and holding” because all mining requires is that the coins produced sells for more than the electricity used. The assets producing the coins shouldn’t be factored into that because they can be sold for a price on their own.

When the craze started there was around a 2x pump from baseline, and peak avg. ROI was just before the massive correction. had you bought rig + electricity value in eth and dumped, you’d have made much, much more, and not had to try and sell off all that pesky mining junk.

It seems your definition of “profitable” is “hitting ROI”. Mine is “making money now for what I put into it”.

If you want to be technical, I’ve made $0 because I’m holding the currencies I mine to sell at a much later date. Though I am trading all Ethereum to Bitcoin because it’s obvious its price is temporary.

What are you on about? it’s trading at ~$202 trending down.

1.3 multiplied by 200 = 260

I mean… basic math here man.

There is another problem, when the SEC decides all cryptocurrency mining are securities miners will have to get a security trading license just to be able to exchange their coins.

You don’t understand what that investigation announcement meant.

It was saying tokens for startup currencies based in cryptocurrencies is a security because you are trading value built into a company just like a stock share is.

So this only holds true if the basis of the currencies value is in a company that maintains it. An ICO is an Initial Coin Offering which is essentially cryptos version of an IPO which is an Initial Public Offering.

This investigation means that companies can’t use cryptocurrencies to get investment funds without being regulated by the SEC. If the currencies aren’t being used for that, they aren’t a security.

Ethereum is used for ICOs a lot and that’s why this announcement is bad for it because that’s a lot of money being put into Ethereum for that purpose.

Currencies that aren’t used for that aren’t subject to the same regulations.

Not all. Just ERC20 tokens and anything with a crowdsale (ethereum, zcash, possibly dash, dozens of smaller shitcoins)

BTC, Monero, LTC are strictly exempt and pass the howie test.

Yes, this.

I’m holding the currencies I mine to sell at a much later date.

Then you definitely aren’t making money. Ethereum Foundation members are under SEC investigation. Shapeshift that shit into BTC if you’re going to hodl.

Well considering you have said it is trending downward, the obvious answer is “yes mining is more profitable than buying and holding”

no, see the following paragraph. Considering you’re long holding, you could have just spent the electricity money on the crypto and have the exact same profit model without the capital expenditures.

It seems your definition of “profitable” is “hitting ROI”

No, it is the stock standard definition used by every serious miner in the business: outperforming raw speculative investment. I just said that.

Mine is “making money now for what I put into it”.

Ignoring aggregate expenditures and capital is how people go out of business. If your goalposts are far, far away from everyone else, of course you’re going to come to different conclusions.

1.3 multiplied by 200 = 260

I mean… basic math here man.

no need to be rude, the way you worded it could easily be interpreted as “eth is trading at 260” or “1.3 eth is worth 260”

Ethereum is arguably a security under the new ruling, and backchannels have foundation members falling off the map and investigators asking questions.

Look, I’m not bashing you personally, and I’m not saying mining reflects negatively on your character. What I’m saying is that hobbyist mining on home electricity in the west isn’t profitable.

Then you definitely aren’t making money. Ethereum Foundation members are under SEC investigation. Shapeshift that shit into BTC if you’re going to hodl.

I am.

no, see the following paragraph.

We’re talking now. What has happened in the past is pointless. It is more profitable right now to be mining than to buy and hold. Nothing else matters because we can’t do anything about what has happened.

No, it is the stock standard definition used by every serious miner in the business: outperforming raw speculative investment.

Well then I’m going to go so far as to say that is a dumb way to look at it for a single small miner. I can either mine for relatively consistent returns (mining ethereum VS electricity costs has been profitable since the popularity boom), or I can speculate and possibly lose or gain money. It seems reasonable that the more consistent investment is the one I’d prefer.

If what you say is true, serious miners are dumb. That’s not what profitability is. Making more money than you spend is being profitable, and anything else is unintuitive and should be called something else, like being more efficient with your money or seeking highest ROI.

Ignoring aggregate expenditures and capital is how people go out of business

The issue with that for me is that I can’t know how much my mining equipment would get me when I sell it. Right now doesn’t count because I’m not doing that. So I ignore both the cost and eventual resale value of the hardware and focus on making sure I’m making good money on mining outside of that, resource for resource (electricity -> coins).

They’re flat costs which are not necessarily reoccurring, so they’re relatively minor imo compared to eventual potential profit.

Ethereum is arguably a security under the new ruling, and backchannels have foundation members falling off the map and investigators asking questions.

Yeah I fully expected to be done with Ethereum after the bitcoin split happens. Not sure what I’d move to, but using pools that switch algorithms based on profitability percentages is a good baseline for figuring that out.

the bitcoin split happens.

assuming it does, just buy btc on bixit now with your eth and dump the altcoin chain fork.Literally double your money.

What has happened in the past is pointless

See:

since the craze started.

At the time of my posting this, the information was 100% accurate and still is.

It is more profitable right now to be mining than to buy and hold.

based on what data? I provided mine. Also, you said you were hodling. That means ‘right now’ doesn’t apply to you. Furthermore, mining as a venture is necessarily over time.

Well then I’m going to go so far as to say that is a dumb way to look at it for a single small miner.

It’s actually the only metric, but if you want to use a different one, home mining isn’t even profitable compared to renting cloud compute to mine. You can use flash pricing on cg cluster instances to intermittently mine far more effectively via the EC2 api, for example.

The issue with that for me is that I can’t know how much my mining equipment would get me when I sell it. Right now doesn’t count because I’m not doing that. So I ignore both the cost and eventual resale value of the hardware and focus on making sure I’m making good money on mining outside of that, resource for resource (electricity -> coins).

look, if you want to redefine profitable, that’s fine. Just don’t claim the standard definition is wrong. I’m not telling you to stop mining.

See:

You said in that same paragraph:

ehtereum hasn’t been profitable since the craze started.

That’s incorrect using the actual definition of profitable.

based on what data? I provided mine. Also, you said you were hodling. That means ‘right now’ doesn’t apply to you.

You’re ignoring the point I’m making. You said:

because the benchmark isn’t whether you’re making more than you’re spending on electricity, it’s whether or not you’re outperforming simply buying and holding the crypto over the same ROI period.

When the craze started there was around a 2x pump frome baseline, and peak avg. ROI was just before the massive correction.

Me saying “We’re talking about right now” is saying “it doesn’t matter what ROI was then” because it doesn’t help anyone now to determine future profitability.

My whole thing is you saying it’s not profitable and hasn’t been since the popularity spiked. I’ve been mining that whole time making more than I’ve spent on electricity, and that is to say I say you are wrong to make that statement.

At the time of my posting this, the information was 100% accurate and still is.

I guess if you redefine profitability to mean higher ROI than just buying and holding, that might be true, but you yourself have said Ethereum is trending downward, which logically means buying and holding starting right now would lose you money. Mining and selling as you get it starting right now would just as likely make you money for a time (at current prices it is still 2:1 to electricity for me).

If your reference for where the best ROI should be calculated from is “when the craze started” or even “before it started”, I don’t know why you’d do that but I think it’s a dumb way to have a conversation about investment.

It’s actually the only metric, but if you want to use a different one, home mining isn’t even profitable compared to renting cloud compute to mine. You can use flash pricing on cg cluster instances to intermittently mine far more effectively via the EC2 api, for example.

???

“if you want to use a different one”

you immediately use your definition again

You’re basically asking me to be rude here. Both give you more money than you put in. Both are profitable. One is more profitable than the other.

Use words correctly please with their actual definitions.

Profit is revenue minus costs. It’s that simple.

Costs = electricity bill; revenue = USD from coin sales.

If I’m making more money than I’m spending, it’s profitable.

look, if you want to redefine profitable, that’s fine. Just don’t claim the standard definition is wrong. I’m not telling you to stop mining.

You’re the one using the wrong definition of what it means to be profitable.

You’re the one using the wrong definition of what it means to be profitable.

I’m not. I’m using the industry standard metric for profitability. That means it’s the correct one as applies to crypto mining, full stop.

Also, a bit hypocritical considering you aren’t factoring in your equipment overhead, variable difficulty, or TIME in your model.

Like I said, not telling you to stop mining. You do you, man.

I stopped for a week but started up again! Got .106btc for about $70CAN in electricity in 4 weeks. If this keeps up I should have enough to exchange for a Vega card for about $100 in electricity. I’m down with that

Got .106btc for about $70CAN in electricity in 4 weeks.

If you’re using nicehash:

a) you aren’t mining, you’re hashpower renting. Subtle difference.

b) you probably aren’t mining ethereum exclusively, if at all, depending on you equipment.

Most of it is ethereum, like 70%+, some is whatever cryptonight is from my r7 1700.

Plus, the title says cryptocurreny

People still believe in eth for now so I’m okay unless btc drops by about 2/3.

I have very little time and money invested in this so maybe I’m not a hobbyist

I’m not. I’m using the industry standard metric for profitability. That means it’s the correct one as applies to crypto mining, full stop.

Also, a bit hypocritical considering you aren’t factoring in your equipment overhead, variable difficulty, or TIME in your model.

Like I said, not telling you to stop mining. You do you, man.

Then I’ll again go so far as to say that’s retarded and means nothing to a small miner.

equipment overhead

Hard to calculate for, and presuming it’s long term it becomes relatively insignificant so long as it is non-recurring, so not worth the effort.

If I’m going to consider future potential profit based on current production, I must consider whatever my equipment overhead could give back when it’s sold. Doing one without the other doesn’t make sense to me unless you ignore equipment overhead, and imo that’s fine as long as it’s a single purchase and not recurring.

variable difficulty and time

If I just mined with the hardware I had during the month of June (from 1st to 30th), I would make more money than I spent, by about 2-3x essentially making $200-$300 for every $100 in electricity I spent. The same has been true for July and will probably be true for August though it depends on what Bitcoin does and how quickly the SEC investigation concludes and what comes of both.

I don’t think it makes sense to say something isn’t profitable if it makes less money than an alternative but still makes money because when normal people see that they’re going to interpret it differently than you do, and imo that’s spreading incorrect information.

Even if that’s the industry standard definition, that’s not the general definition and actually means something very different from it. It sounds like something made to create F.U.D. and doesn’t seem like a good decision to me.

Avoiding industry specific technical terms is a good idea when talking to normies, unless you explain the difference beforehand.

you’re probably using amd cards, right?

They’re better at Hashimoto.

Again, nicehash isn’t mining. It’s taking advantage of arbitrage on a pool renting marketplace.

I mean I guess so? I’m getting paid to mine today what other people are speculating about for tomorrow.

OK:

100$/mo in consumer electricity is about 1200 W.

If you’re mining 1.3 at the current difficulty that’s about 140ish MH/s

that profile approximately fits five 1070’s or 5 8G 480/580’s plus a base system plus a high wattage PSU plus risers

so between ~$1600-2500 assuming you got in early and cheaped out on everything but the psu.

If you’ve been mining and hodling since late march, (earliest interpretation of start of the craze) that’s 4 payouts of 1.3 now valued at $260, or $1040 - $400 = $640

There is no universe where you’re profitable, yet, even if you don’t use the non-industry definition, and even if you had free electricity. There’s even room for another month in the backend!

Avoiding industry specific technical terms is a good idea when talking to normies, unless you explain the difference beforehand.

I did explain. I said profitability for crypto was measured against raw investment in my first post. You then took umbrage with my trying to explain this

F.U.D.

Yes, everything I disagree with is FUD too. What a coincidence.

Like I said, subtle difference.

Multimining is still mining, but if you’re selling hashpower on an externality marketplace to determine what to multimine, it becomes hashpower renting.

I wasn’t disagreeing with you, but it’s good to know, right?

I feel like a winner.

New Rx Vega will fit nicely beside my r7