OK.

I’m going to say that the value of your mining is based solely upon the price of the coin at the time it’s mined as the process of coming into ownership of the coin is identical to having just bought it with “real money”, so any additional value gained or lost after the mining process by trading or waiting for a month when it’s higher etc. is completely detached.

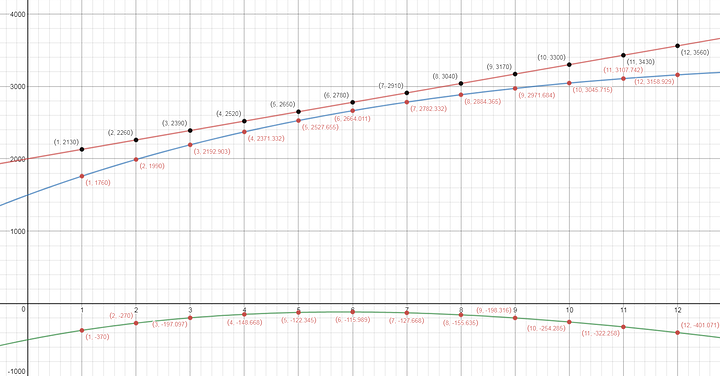

Given an initial cost of $2000 and a monthly cost of $130 thereafter, with an initial income of $310 which degrades each month by ~9.677% (from the optimistic side of your estimation on how much you’ll earn next month div this month’s (280/310)), and a current estimated resale value of your miner of $1500, decreasing by $50/month, we get this 12 month plot…

The red line’s your costs (albeit probably a limited scope of them - only including the initial cost of your miner and your monthly electricity bill).

The blue line’s the money you’ve taken in + the estimated resale value of your miner at the time.

The green line’s your profit (so, blue line - red line).

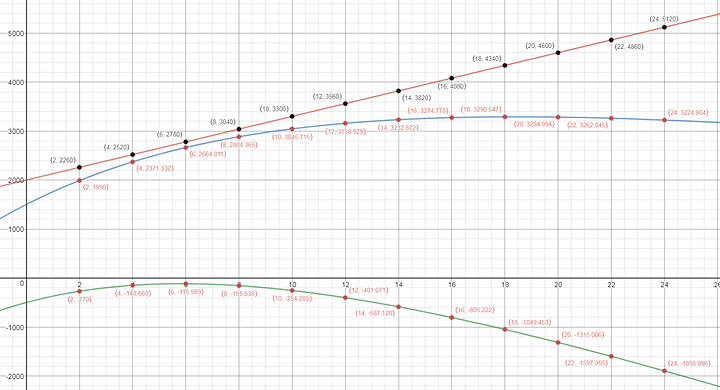

If you really want I could expand that to a 24 month plot but the trend’s pretty obvious already so I don’t think there’s need.

What I miss? How do you make profit on this? The best I’m seeing is you getting out of this at around 6 months in with ~$116 in losses.