you’re the kind of person alts get shilled to… I wrote this and then wanted to delete it since it’s unlikely you even read it – but just take it as what it is. information.

“backing” with anything that is entangled with the current system and its rules and problems is not a bonus.

nothing is harder than math.

“backing” is done to lessen the impact of third party abuse or failure in financial instruments.

bitcoin has no third party except math in the first place.

THAT was the whole point! – if you asked someone in 2014 what a cryptocurrency is, they’d have said: “a way to transfer value without a third party.”

yes, bitcoin was created to do away with third parties and give people direct control!

any “crypto” that introduces “backing” is just exploiting people’s ignorance of how this all works.

you clearly do not know either. – “backing” adds a new variable that can do nothing but weaken the system.

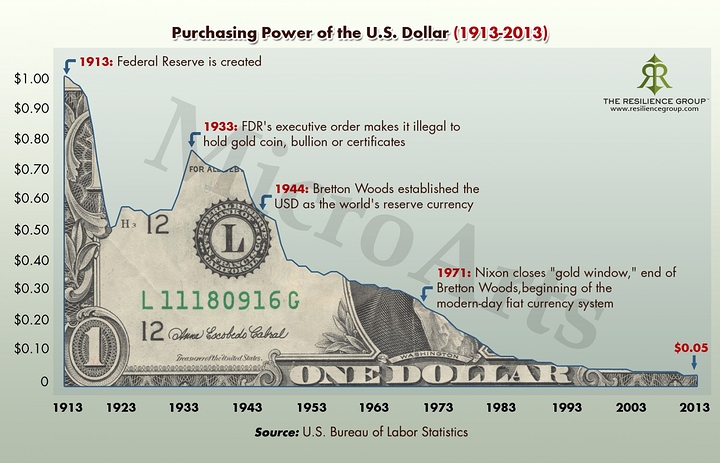

the dollar was backed by gold once. that was a good idea, since dollars are not ruled by math, but by the whim of a banker or politician. get the difference?

you read something that sounds great, “makes sense” and believe it, because you never put in the work to understand bitcoin. that is in turn exploited, just like people’s ignorance of block size and decentralization, which is how bcash got big: some never get how bitcoin works. and those people will always fall for scams.

don’t be one of them

did you put years of your life into this? no? then I’d suggest studying up, not explaining whats wrong with it

again: zero understanding, but a lot of “knowledge” that is false. from this you draw even more false conclusions

bitcoin is piss easy to use, just incredibly hard to understand. you download a wallet and use it. what’s difficult about that?

download the green wallet: https://blockstream.com/green/

want bitcoin?

CashApp made by the Twitter CEO has ~10 million users already! transfer any bitcoin to your green wallet.

try opening a bank account. or buy shares. way more difficult.

a) Bitcoin: any payment is processed the second you send the transaction. nobody needs to wait 10m for a coffee transaction since double spending this would cost millions of USD – who does that for a coffee?

but when is it SETTLED? after 10m

Google, Apple, VISA… any payment you send is settled when the chargeback time limit is over. i.e. weeks.

bticoin is honest with you: it says unconfirmed, when a payment truly is unconfirmed, i.e. not settled. that doesn’t mean it hasn’t been processed or is not, for all intents and purposes, final.

banks and visa act like it’s settled, but it’s not at all – which is why chargeback fraud is rampant. the current powers that be see this as a feature, not as a bug, since it crushes small businesses, who get crushed by exploits like this. and laws and regulation is done by and for the biggest players in the market: i.e. Amazon et al.

you do not understand bitcoin or the current financial system and its flaws, and think you do.

it’s a Dunning Kruger situation. you know so little that you think you know quite a lot.

b) you also have the habit of not reading my posts, and then lecturing me about something I’ve already told you:

Lightning is bitcoin that settles instantly. so you’re wrong and wrong again.

instead of asking what Lightning is, (mentioned in the very post you quote from, dude!), or asking what a layer two or layer three technology is, you assume – and make the proverbial “ass out of u and me” [ass u me]

Lightning is a layer two technology. it is bitcoin. just instant.

I don’t even know what to answer for the rest… it’s complete nonsense on a level that is hard to describe.

non-sequiturs within non-sequiturs…

I’ll try:

China? maybe don’t get your news from TV? everything you’ve mentioned never happened! you clearly get your news from sources that want to keep you docile and ill-informed.

you seem to be unaware that only bitcoin has the size to withstand a nation state attack on the network.

since you know jack sh!t about security in this area, maybe not jump to conclusions and accuse and assume?

there is a very real reason size matters, because size equals security – hashrate of the network directly determines how secure it is

lol? srsly?

I can’t even talk to you if that’s something you honestly believe. it’s like a compressed version of dense.

banks hate bitcoin because bitcoin makes third parties, aka banks, obsolete!

jumps in value are not ok? you sober, bro?

do you understand that the $ is worth zero – it is merely distributed according to who is in power. no one except a few profit off this system.

any system that provably represents a new way of doing money is infinitely worth more.

so sudden jumps in value should not be ok?

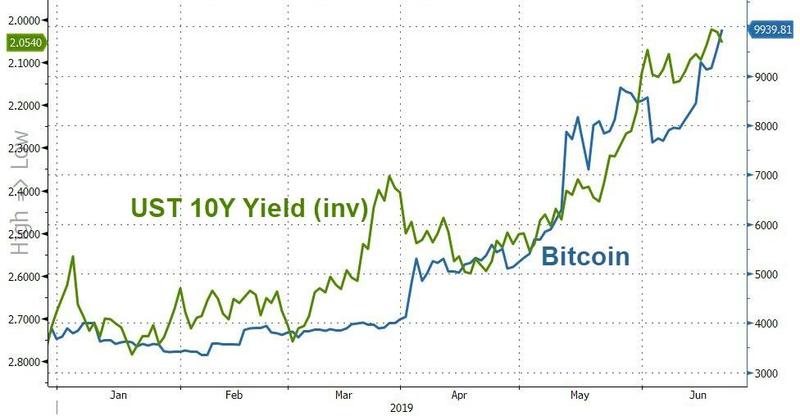

this decline in value is planned. inflation is the GOAL. ask the Fed: they think deflation – money gaining value – is the devil personified. bitcoin is designed to be deflationary.

it’s designed to go up. how is that bad?

Ethereum just announced it will KILL OFF the whole thing that is now Ethereum and restart on a new blockchain (while trying to migrate all their scammy ICOs to the new chain) talk about going nowhere…

what do a few 1000 graphics cards have to do with a 100 billion dollar market of ICOs? lol???

what are you even talking about?

I was talking about the very core level of their protocol and you argue that something that can’t even be used to mine profitably any more is related to Ethereum killing its own blockchain off?

the best part is: you have NO IDEA that Ethereum is trying to go proof of stake: i.e. no mining.

it’s not like Vitalik can ever stfu about proof of stake… and the endless delays due to security issues

but keep on lecturing us!

and of course you just have to go to the “conspiracies” accusation… since you have followed this market and the people involved so much that you can assuredly say I am wrong, right?

you do not know the very basics of what a cryptocurrency is, of what bitcoin is, what Ethereum’s issues are, how banks make money, how the financial system works, how irrelevant normie computer hardware is to crypto in general

maybe I know a thing or two about the goings on in my field of expertise? maybe I say things for a reason?

I know, it is hard to imagine, but some people think first and try to educate themselves first before posting something.

. cheap is easily done. nothing is more convenient than slavery

. cheap is easily done. nothing is more convenient than slavery