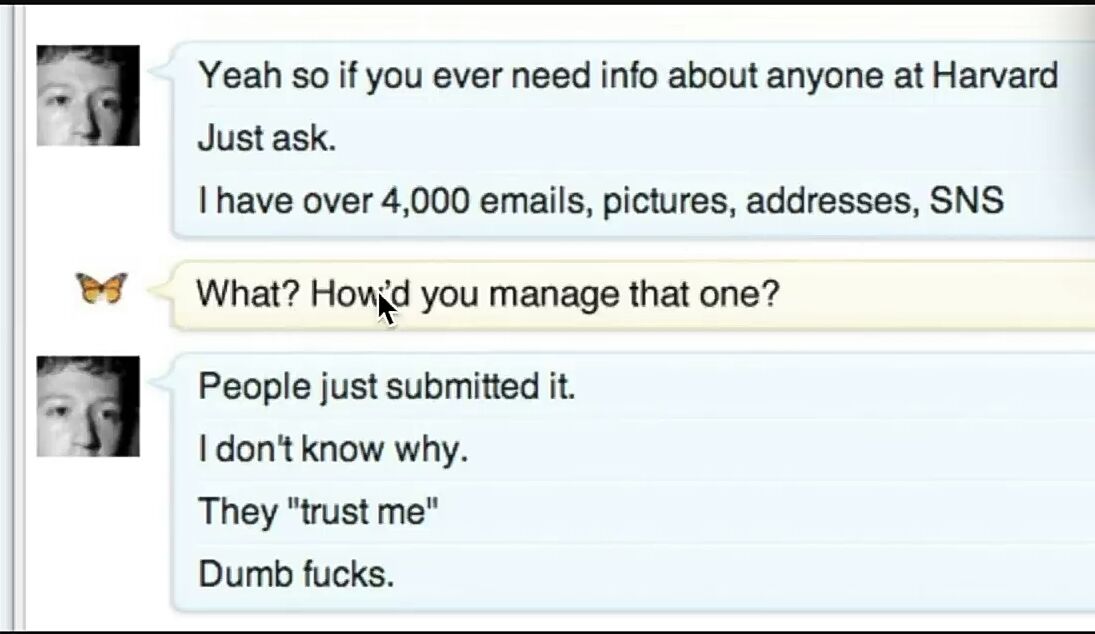

since Libra, should it ever be fully operational, affects us all, I wanted to clear up some things that tech media and media in general is either not talking about, or misrepresenting

what is Libra?

If you ask Zuck, it’s a “cryptocurrency” – or it’s “blockchain”.

so what is crypto/blockchain?

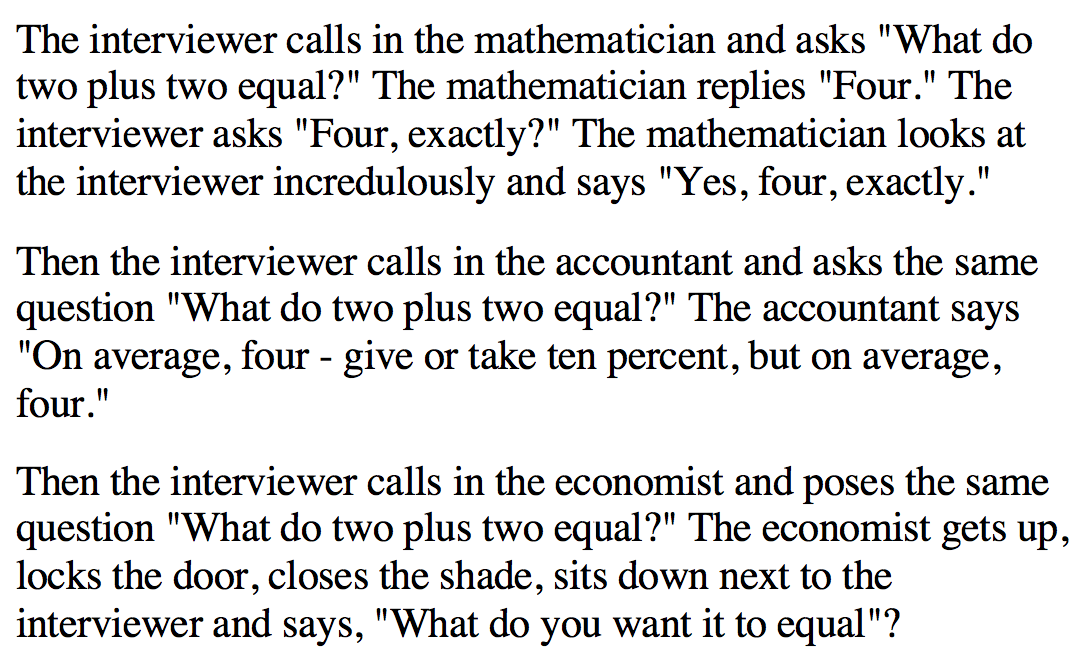

it’s a convenient buzz word to sell you old ideas in a flashy new package.

there is not such thing as “blockchain” as in “blockchain technology”.

it’s all bitcoin but a cut down, mutilated husk.

Bitcoin created an immutable ledger enabling uncensorable transactions. Money, but as it once was, before governments could print it from nothing, and censor transactions.

Gold was cash once. nobody could stop you from afar when you wanted to make an in-person payment in 1700.

Nobody could simply print it from nothing.

and bitcoin adds all the advantage that it be sent online, but stored offline.

the media started to call this system a “blockchain”, even though it basically just means bitcoin. why? because every “blockchain project” had a financial interest to sell a forked, rebranded bitcoin sans bitcoin features as some sort of future tech.

whatever someone can promise to get people who don’t know any better to give them billions for sh!tcoins and ICOs.

Libra is merely the latest fraud project that combines all the disadvantages of software based money with all those of current banking and fiat money [Ripple/XRP is an older one, Ethereum is another. promised the world, only delivered us scammy ICOs]:

Libra is neither immutable, nor uncensorable. the very thing why anyone would ever need use a blockchain – since you can only get those qualities via a blockchain – which already exists and is called bitcoin.

Libra is centralized. all power lies with node operators that are chosen by the people who create Libra. i.e. Facebook.

Libra can and will censor payments. They have to because they can. Not that Zuckerberg is not already the biggest fan of censorship: even if he wanted to, Libra as an entity that has a legal structure must obey the same insane legislation and rules that screwed up the current system so much that Bitcoin was invented to get away from.

Libra is owned and controlled by people fully invested in current fiat and banking. Paypal and Visa are onboard.

Libra promises to enable payments that have almost no fees. right after launch. then what?

Libra can see and data mine even the tiniest thing you use your money for and the whole cartel which controls it will get access to the data.

I saw two extremely well known tech youtubers (not lvl1techs) I like discuss it briefly and uncritically regurgitate a press release poorly disguised as a news article as if it was factual – it was so painful to watch.

Libra is a scam. plain and simple.

it repackages current tech and financial systems, adds hyper surveillance, adds a perfect setup for a social credit system akin to China (google that for nightmares), is a complete security nightmare, since centralized blockchains are nothing but a centralized database (no immutability means wholly hackable) and cloaks all of this under a this “blockchain” scam term.

let’s compare:

Fees – the main selling point of Libra:

Libra: “almost none” (at start – changeable on a whim)

bitcoin: zero fees with lightning (a layer two bitcoin technology)

Surveillance / “User is the product, not the customer”

Libra: user is the product – all data are belong to Zuck’s group

bitcoin: user is a user. nothing more. bitcoin is fully transparent. thus surveillable. Lightning however in’t. and that will be (and is already) used for exactly the kind of sums that Libra will be used for: coffee, some tech toy, buying a t-shirt and so on.

if you want anonymity, Monero is bitcoin plus that. zcash / dash and all the other privacy coins are clever scams.

Monero is the only thing anyone uses who actually wants privacy.

proof: there are a handful of truly decentralized exchanges that work.

bisq.network makes up 95% of that market.

what makes almost 100% of bisq’s volume is Monero <-> bitcoin. several million USD every month.

zcash and dash is offered. but trades in those are 100$ a day or 0$. there is no real market for scams

value proposition:

Libra: it’s a stablecoin that’s based on the Dollar masquerading as a great new thing for the masses. that’s it.

it has all the risk fiat money has, plus the risk of corporate entities, plus it’s hackable.

no one in their right mind would want to hold larger amounts of Libra.

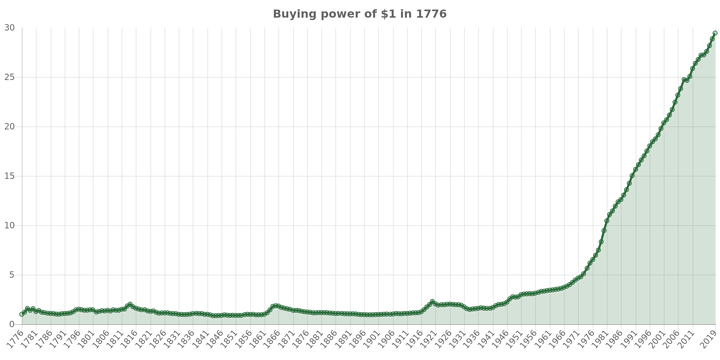

Bitcoin: the only money that is uncensorable, immutable and harder than gold. gold supply doubles every 60y (yes. gold has a built-in inflation)

Bitcoin has already mined 18 million of its 21 million fixed supply. and mining rewards will be cut down by half in less than 11 months. this so called “halving” is why we’re seeing the recent doubling in price. and it will continue.

people may not be aware, but the liquid supply of bitcoin is razor thin. almost all of it is rarely moved. should the supply of freshly mined bitcoin get halved, essentially the liquid supply halves as well. this is a built in method to make bitcoin deflationary.

which brings me to the conclusion:

Libra is a scam.

it will, if they can ever bring this buggy mess to market, be “used” at least. mostly it will be talked about.

as such, it is useful to bitcoin & Monero as proof for slow normies that “crypto” is taken seriously and has practical use – the media will hype Libra as some sort of savior for poor people, when it merely is the newest tick on their back – say hello to low social credit score via your past Zuckbucks purchases and a ticket to the “no fly list”-zone a la China.

then people will think about if maybe using lightning, which is instant, costs no fees, and is way more private, might not be a better idea.

or Monero, if you want to do bigger business in private.

or bitcoin, if you want to store your saving out of reach of governments and banks

I hope I’ve shed some light on the subject.

I’d not have written this if I ever had heard a reasonably sound discussion on this in tech circles.

but all I’ve heard are people reading “news stories” without context or understanding of the subject matter, voiced annoyance of some disruption of hardware prices or similar nonsense.

as Libra shows, Bitcoin is taken extremely seriously.

it may help bitcoin’s adoption. but it’s surely not meant that way. It’s an attempt of cashing in on an open source payment system, bitcoin, that has a 175 Billion $ market capitalization right now.

Libra and the corporate consortium behind it want to make it sound like they are the big fish here. They are not.

All Libra can do is redistribute fractions of the current economy into a new data mining environment and thereby educate people on how easily banks can and should be circumvented.

Libra wants to come out in 2020. By then bitcoin, driven by the halving in May 2020, will be at 1750 Billion dollar market cap and 100,000$

Libra isn’t a place to store money. not even Facebook believes that – or they’d not directly market it as money for people who have no money (look at their ad. they seem completely unaware that’s their pitch. Zucks billions make him really feel the pain of the common man, it seems).

no one can or would trust your money to an entity that can censor you for speech and freeze your savings – if you have any.

people will trust bitcoin or Monero.

people who want to buy a coffee will use lightning, which is bitcoin – but without the blockchain

as such, the project Libra is doomed. it’s 20 years too late. software based money that is centralized was possible in the 90s.

Hell, technically, the dollar is now software based money.

the only reason it’s being tried now by corporate America is fear of change. It is a desperate and futile attempt to get a cut of bitcoin’s market share – instead of directly participating in bitcoin.

they’ll sooner or later realize they did “TV text” and tried to compete with “the internet”.

this is a log chart of bitcoin’s full price history: – the media never shows log charts. or their “bubble” narrative would pop –

this chart goes from 2$ to today’s 10900$ – it looks very smooth. bitcoin is not a Keynesian entity. it is also not cyclical.

bitcoin represents a shift in technology. these shifts are extremely one-sided.

Libra would always stay at 1$ – a Dollar that will buy you less and less every year, because inflation is built into every Keynesian money – (incidentally, every country that did refuse to introduce a Keynesian currency [which would then be inevitably bound to the $] got either ‘liberated’ by the US, or is on the permanent rogue state list, marked for future ‘liberation’)

it isn’t hard to see that inevitably, people will rather choose a money that increases in purchasing value, rather one that goes slowly to zero, like all Keynesian fiat money does.

bitcoin is code. there was a supreme court decision in the 90s that made clear that code, since it can be printed on paper, and put in book form, is protected by freedom of speech.

thus every “license” or whatever the US gov would put on bitcoin is inherently unconstitutional.

this is why bitcoin is unstoppable and why Libra is dead on arrival

links:

Bitcoin:

bitcoincore[.]org bitcoincore.org

avoid: bitcoin. org (people currently in charge have shown some odd behavior and some odd mistakes in updating links)

avoid: bitcoin. com – straight up scam website trying to sell you a cheap knockoff of bitcoin, run by convicted felon and scam artist Roger Ver*

Monero:

getmonero.org – only use sites linked from there

Lightning:

https://lightning.network/

decentralized exchange sans any KYC or data harvesting:

https://bisq.network – using bisq is very different – so just be patient. the people behind it are trustworthy, but as with bitcoin, it’s trustless. you do not need to trust them, since they never actually control your money.

YOU always have the keys. no one else.

this is what a decentralized exchange is. beware sites and services proclaiming to be a “DEX” (like Binance’s) and then being able to lock you out or own your keys.

not -your- keys, not- your -bitcoin.

wallets for android & iOS

bitcoin satellite network:

storing bitcoin offline:

(no company is perfect, neither is ledger, but I have much less faith in competing hardware wallets. this is likely the best solution and safest storage. I’d use the Ledger Nano X with the USB C cable, not bluetooth.)

last and most important tip:

never keep your bitcoin or monero on an exchange. buy, then store in your wallet. not your keys, not your bitcoin. never forget that. coinbase has frozen people’s accounts in the past – something impossible in bitcoin itself. not impossible if you do not own “your” bitcoin.

not -your- keys, not- your -bitcoin.

avoid coinbase. I could write 100 pages about what coinbase has done to people, how many scams they’ve pulled, what people they willingly associate with (they hired the very same people that got that journalist Khasogghi murdered and cut up into tiny pieces after being tortured to death)

coinbase is and always has been the #1 enemy of bitcoin (even worse than #2 Bitpay, who screwed Valve over so hard that they dropped bitcoin support – Bitpay asked for 5-10x the fees that the network itself wanted, had an arbitrary time limit on purchases, that had no reason whatsoever in bitcoin design, or network rules).

for an outsider, it is a tough thing to explain. but it makes sense. corporations aren’t beholden to their outwardly stated business model, but to the people they are owned by.

and a lot of early bitcoin related companies got bought or funded by the old school financial sector, who wants to stay in charge, and sink bitcoin by undermining its businesses.

nowadays, coinbase has stooped to selling knock-off bitcoin as the real thing. they push scam coins like XRP, “bitcoin cash” and other crap that has a fair value of zero.

good exchanges are: Kraken, Bitstamp, Bitfinex and if you want obscure alt coins, Binance. Binance isn’t “good”, it’s just the least worst in that area. I’d stick to the 3 listed above