So, once she starts college she will receive a 1098-T in her name. That paper will most likely go with your return.

The rules surrounding dependents once they get to college age are somewhat confusing so hopefully I can help explain things in a way most can understand.

- They need to live with you more than half the year (Living on campus counts as living with you as it’s a temporary absence from the home)

- They need to be in school more than 5 months

- They need to be under age 24 at the end of the year

-

They CANNOT claim themselves on their own tax return, HOWEVER, they can (or may need to depending on their circumstances) file a return. This is just like anyone else filing a tax return, just they don’t claim themselves on there because they are a dependent of another.

So, if they are indeed your dependent pursuant to the above list you now potentially have access to one of 2 credits or 1 adjustment.

Let’s look at the credits first (since they’re what you’ll most likely want).

The first of the credits is the American Opportunity Credit (AOTC). This is the big one. It is worth up to $2,500 of which $1,500 is refundable (a credit that can be taken even with no tax liability). It can only be claimed for 4 years so you want to save this one until they are in school full time. It is based off of “qualified expenses” which for the purposes of this credit include things that need to be paid to the institution in order for the student to be a student (i.e. tuition, fees, etc) in addition to books. This does not include things like food or room and board.

The other credit which is available is called the Lifetime Learning Credit (LLC). This is slightly smaller at only $2000 and is entirely non-refundable (you can only claim the amount up to your tax liability). It is also figured a bit differently than the AOTC in that it is a straight 20% credit. This means, if you have 10k of qualified expenses (the max allowable for the credit) you may be eligible for the full $2,000, where under the AOTC it would reach the max credit amount at a lower qualified expense amount. The other way in which this credit differs significantly from the AOTC is they do not allow books to be included in the qualified expenses. You can, however, claim this credit an unlimited number of times.

The adjustment that is available is the tuition and fees deduction. This also has a max dollar amount on it and only lowers your taxable income by up to that amount. I don’t have the book in front of me so I can’t say for certain what those amounts are, but I’ve never done a return with one on there because the LLC is just so much better than this one in basically every situation.

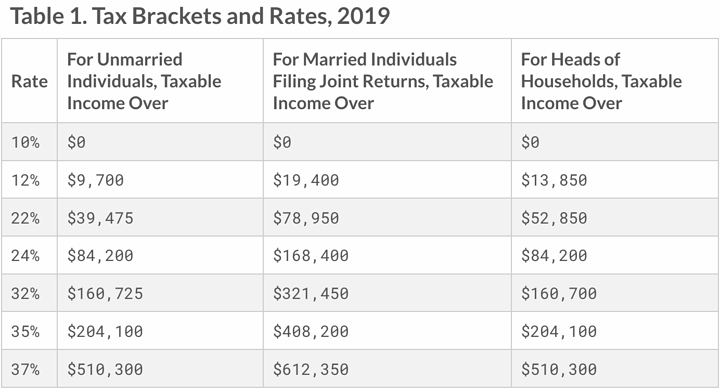

With these credits there are income phaseouts, so if you make over a certain amount your max credit decreases down to zero.

As far as what to use when figuring the qualified expenses you should get a copy of your dependent student’s college account record showing the tuition, fees, books (if claiming the AOTC), along with the scholarships and grants that are taken. Those scholarships and grants reduce the amount of qualified expenses that can be claimed so if you end up with more of those than expenses then you are SOL. Loans don’t affect the calculation at all.

Now what I sometimes do for my clients is figure what the child would’ve received if they did claim themselves to see what they would’ve gotten, then the parents will give them what the child would’ve gotten and everyone comes out ahead because the benefit is much greater on their return than the child’s. Which could be something to think about.

)

) . It’s not Cali that takes the se tax, well they do take some but the figure I gave you is the federal amount (you have a federal as well as state income tax if you were unaware).

. It’s not Cali that takes the se tax, well they do take some but the figure I gave you is the federal amount (you have a federal as well as state income tax if you were unaware).